- Gives you the working Capital you Need

- Sell your Invoices Today - Get Paid Tomorrow

- Financial Freedom is One Click Away

What is Invoice Factoring and do you Qualify?

Account Receivable Financing is when a company sells its Accounts Receivables to a factoring company, for immediate cash. It's a financial, working capital tool that many industries use to convert their aging invoices into cash, without having to wait to get paid by their customers. When your company provides a service or sells a product, you generate an invoice, set the net terms for the payment and wait the appropriate time to receive payment for that invoice. If your business is growing, or if you have slow-paying clients, you might not have a positive cash flow. Some well-established companies with perfect credit; offset this problem by applying for a loan at a bank. In difficult economic times and as federal bank regulations continue to be an issue, it’s no longer a simple task to obtain a bank loan. The costs, process and time frame to get the loan, is appalling, which is why so many companies have decided to use account receivable financing companies, as an alternative to traditional and terrestrial bank loans.

What is the difference between Accounts Receivable Financing / Invoice Factoring / Invoice Financing ?

Nothing, all three are exactly the same. We address all three terms here because many people call us thinking there is a difference. Some of our callers inquire about Accounts Receivable Financing opposed to invoice factoring because they heard of factoring. We have a section for Accounts Receivable Financing as some of our customers are searching online specifically under this name.

Does your company have assets, but lack liquidity, it’s the same thing as living paycheck to paycheck; you might be able to do this for a while but there are always rainy days where we all need access to cash. All businesses need to be prepared when this happens. Your account receivables are assets and they are worth the face value of each invoice amount.

Your company probably has some clients paying their invoices rapidly, but it’s more likely that most of your clients are not paying in a timely manner, which puts financial stress on your business. When you use an account receivable financing company, you are not required to sell every invoice from every customer. Most companies only sell invoices from slower paying customers. If you were to invoice one of your customers today, where they made a payment immediately, there would be no reason to sell us this invoice. If you have to wait 30, 60 or 90 days to get paid, you might want to consider selling these invoices to a factoring company

How much do you currently have in aging invoices? When are you expecting to get paid on these invoices? If you were able to sell all of your aging invoices today, for immediate cash tomorrow, would this solve some or all of your financial problems?

The larger your company gets, the more money you need to help it grow. You might be looking to hire more people, purchase additional inventory, take on new office space, purchase more equipment and dare I say; even pay yourself. Account receivable financing is more popular today than ever before. Businesses have been flocking to the invoice factoring industry to finance their companies as a cheaper, more efficient, faster and less monotonous alternative method of financing, than trying to obtain a bank loan. How are you running your business? What are your plans to grow? What vehicle will you use to get you to the next level?

When your company invoices a client, a standard net term would be between 30 and 60 days to collect on this invoice. In tough economic times, your clients are either paying the invoice on the last possible day or they are paying this invoice well past the terms that you allocated. Your company is still expected to pay your monthly expenses and payroll in a timely manner. If you choose to use a factoring company to finance your account receivables, you will never again have to be worried about when you will be getting paid, it no longer matters if your clients pay in 30, 60 or even 90 days, ever again. When you factor your invoices, you are always 24 hours away from the funding of that invoice.

Many industries suffer from the lack of positive cash flow, which is why business to business companies turn to the invoice factoring industry to resolve their cash flow troubles.

Account Receivable Financing For Startup Companies

Small to Mid-sized companies, including start-up companies have an even bigger disadvantage than larger well-established companies, as it pertains to obtaining a line of credit from a bank, due to the time-frame in business or due to the creditworthiness of the company and or the business owners. If you are a start-up, small or mid-sized company, selling your account receivables to a factoring company might be the difference in business growth and insolvency.

Invoice Financing For Mid-sized and Large Companies

Account Receivable Financing For Mid-sized and large companies is important for your business growth. Being financially stable is directly tied to the timeliness of the collection of your account receivables. Mid-sized and Large companies normally extend credit lines to their customers; the amount of credit issued is based on the creditworthiness of their client along with their own ability to have the funds available to stay afloat until the invoices are paid. The bigger a company gets, the more credit is needed to extend to your existing and new clients and the need for additional inventory is also necessary to meet the growing demand for your products. Mid-sized and Large companies also feel the pinch when dealing with slower paying customers; this is a big reason why mid-sized companies turn to the factoring industry for account receivable financing.

When businesses choose to sell their receivables to an invoice factoring company, the invoices are paid immediately. If you are interested in invoice factoring, personal credit is a non-issue, there are no personal guarantees, no new debt is accrued, there are unlimited capital and elimination of your bad debt.

Account Receivable Financing has been assisting the business to the business industry for hundreds of years. It’s an amazing financial, underutilized tool that can make the difference in stability and insolvency. The signup process is simple, the fees are extremely low and the funding of your invoices is reliable and fast.

We solve your monetary problem, for a better tomorrow!

Account Receivable Financing with Alliance One LLC

Alliance One is a New York-based company that specializes in factoring to small, midsize and large businesses. We created quite a buzz in the factoring community for their unprecedented service.

Alliance One LLC is an owner-operated factoring company that has helped hundreds of companies with their financial needs; we solve our customer's needs by providing immediate cash so our customers can run their business smoothly. In return factoring allows the client to sell their account receivables to Alliance One. This is a proven method that helps both the company to be an ally for mutual benefits. The cash provided can be used to achieve business goals that require an immediate influx of cash.

Account Receivable Financing is better, faster and less expensive than taking a loan. It's easier because it doesn't require any credit history or collateral. There are no loans to pay back, it’s money that is paid in advance against your aging invoices. Customers can take 30, 60, and sometimes 90 days to make payments on the invoices, you never have to wait to get paid on your aging invoices again.

“In addition to paying your cash for your receivables, we also provide a variety of back-office services: collections, aging reports, and billing. We take care of the small stuff so you can focus on the big stuff”(Name of the Owner), Owner Alliance One.

We offer the following (but not limited to)

- 24-hour funding

- Flexible terms

- No banking red tape

- No start-up fees

- Competitive rates

- Easy Application

Benefits of Partnering with Alliance One LLC

- Improved Cash Flow and Working Capital - Instead of waiting for your customers to pay their invoices, factoring provides immediate cash you can use to achieve your business objectives.

- Capitalize on Opportunities - with cash flow tied to your sales (aging invoices), you can take advantage of growth opportunities including new sales and marketing initiatives, equipment for expansion, securing new accounts, additional inventory

- An alternative to Loans or Borrowing - Many lenders avoid small and medium-sized businesses, especially young companies. We realize every business has to start someplace. Factoring offers you the working capital your business needs while other forms of financing simply put limits on you

- Reduced Operating Expenses - use the cash from factoring to qualify for cash discounts from your suppliers and eliminate the overhead of the collection process.

- Improved or Strengthened Credit - with cash in hand, you can quickly pay your bills (and take advantage of your suppliers' discounts), your payroll, your taxes

- Stronger Balance Sheet - because factoring is not a loan, it doesn't appear on your balance sheet as an expense. You get the benefit of a loan without the traditional downside.

- Value-Added Services - in addition to improving your cash flow, as your factor we offer professional bookkeeping and collection services so you can focus on what you do best.

Alliance One LLC

Invoice Factoring \ Account Receivable Financing

For New and Established, Small and Mid-Size Businesses

Call Us: 631-435-1000

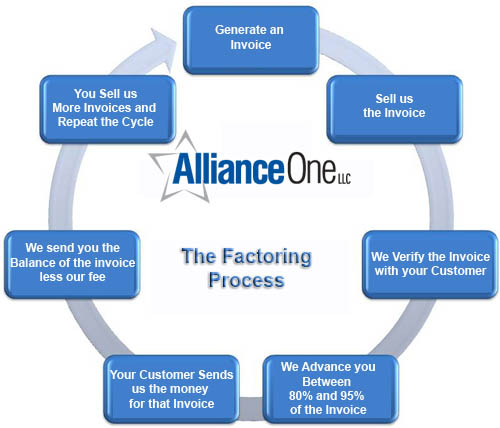

HOW INVOICE FACTORING WORKS