Will Invoice Factoring will give you cash-flow to run your business?

A Comprehensive Guide by Alliance One LLC the Invoice Factoring Company

Invoice factoring is a financial service that allows businesses to sell their accounts receivable to a factoring company at a discounted rate in exchange for immediate cash. This process enables companies to convert their outstanding invoices into working capital without waiting for the usual 30, 60, or 90 days for customers to pay. As a premier invoice financing company with over 50 years of experience, Alliance One LLC offers flexible and affordable invoice factoring services across 49 states, excluding California. Invoice factoring, also known as accounts receivable factoring, involves selling invoices to a factoring company. In exchange, the factoring company advances a significant portion of the invoice amount, typically within 24 hours. The remaining balance, minus the factoring fee, is held in a reserve account and released once the customer pays the invoice directly to the factoring company. Apply Today

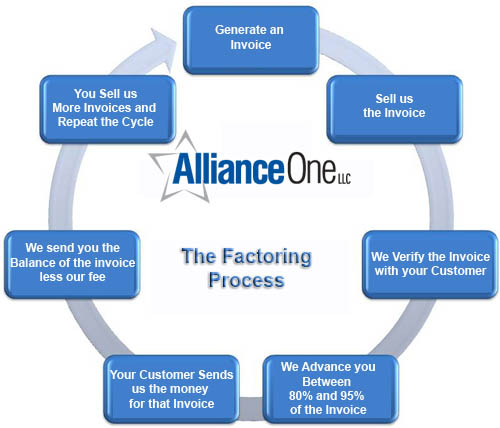

How Invoice Factoring Works

The process of invoice factoring is straightforward and involves the following steps:

- Your company provides a product or service to a customer and issues an invoice for the amount due.

- Instead of waiting for the customer to pay, you sell the invoice to a factoring company like Alliance One LLC.

- You submit a copy of the invoice to the factoring company, which verifies its validity.

- The factoring company advances a large percentage of the invoice amount to your company, usually within 24 hours.

- The remaining amount is placed in a reserve account, which is released to you once the customer pays the invoice, minus the factoring fee.

Benefits of Invoice Factoring

Invoice factoring offers several advantages that make it an attractive option for many businesses: One of the most significant benefits of invoice factoring is the immediate cash flow it provides. By converting invoices into cash, businesses can meet their financial obligations, pay employees, and invest in growth opportunities without waiting for customers to pay. Alliance One LLC allows businesses to choose which invoices they want to factor and which customers to involve. Unlike other factoring companies that require businesses to factor a large percentage of their invoices, Alliance One only requires the sale of one invoice every 30 days over a one-year agreement period.

No Debt Incurred & Focus on Business Operations

Invoice factoring is not a loan, which means businesses do not incur debt or have to worry about monthly repayments. Instead, they are simply selling their receivables at a discounted rate.

By outsourcing the management of accounts receivable to a factoring company, businesses can focus on their core operations and growth strategies without being burdened by the administrative tasks of chasing payments.

Is Invoice Factoring Right for Your Business?

While invoice factoring offers numerous benefits, it is essential to determine whether it is the right solution for your business. Here are some factors to consider:

Business Size and Industry - Invoice factoring is suitable for a wide range of industries, including manufacturing, staffing, and professional services. Small to medium-sized businesses that experience cash flow challenges due to delayed customer payments can particularly benefit from factoring.

Customer Creditworthiness - The factoring company will assess the creditworthiness of your customers since they are responsible for paying the invoices. Therefore, businesses with reliable and creditworthy customers are more likely to benefit from invoice factoring.

Growth Potential - If your business is growing rapidly and you need immediate cash to invest in new opportunities, invoice factoring can provide the necessary working capital to support your expansion.

Administrative Burden - If managing accounts receivable and chasing payments is taking up valuable time and resources, invoice factoring can alleviate this burden, allowing you to focus on your core business activities.

Cost Considerations - While invoice factoring provides immediate cash flow, it comes at a cost. The factoring fee, which is a percentage of the invoice amount, should be considered when evaluating the overall financial impact on your business.

How Alliance One LLC Can Help Grow Your Business

At Alliance One LLC, we understand the importance of cash flow for business success. With over 50 years of experience in the financing industry, we offer tailored invoice factoring solutions to meet your specific needs. Here’s how we stand out:

- Experience: With decades of experience, we have the expertise to handle your invoice factoring needs efficiently and effectively.

- Flexibility: We provide flexible terms, allowing you to select the invoices you want to factor and the customers you want to involve.

- Quick Turnaround: We advance the lion's share of the invoice amount within 24 hours, ensuring you have the cash flow you need when you need it.

- Customer Service: We pride ourselves on our exceptional customer service, acting as your financial partner rather than just a service provider.

- No Collection Calls: Unlike collection agencies, we do not call your clients demanding payments. Our approach is professional and respectful, maintaining your business relationships.

- Complete our non-binding Factoring Application Now

Key Considerations for Selecting the Best Partner for Your Business

Choosing the right invoice factoring company is a crucial decision for any business looking to improve cash flow and maintain steady operations. While most factoring companies operate similarly, there are significant distinctions that can affect your bottom line and overall experience. Here are some important factors to consider when selecting the right factoring company for your needs.

Understanding Factoring Fees - Importance of an Experienced Account Representative - Longevity and Stability of the Factoring Company

Most invoice factoring companies charge a factoring fee, which is a percentage of the invoice value. However, it's essential to understand the complete fee structure of each company. Alliance One, for instance, is a traditional factoring company that charges only one fee, the factoring fee. Unlike many other companies, Alliance One does not impose an additional APR on top of the factoring fee, nor do they include any hidden or "junk" fees.

Another crucial aspect to consider is the experience and professionalism of the account representative assigned to your account. This person will be interacting with your customers on a daily or weekly basis, so it's vital to have someone seasoned and courteous. A well-trained representative can help maintain positive relationships with your clients, while a less experienced or poorly mannered representative could harm your business reputation.

The longevity and financial stability of a factoring company are also important considerations. A company that has been in business for many years likely has a proven track record and staying power, which can provide peace of mind that they will be able to support your business in the long term. Ensure that the company you choose has a solid history and a reputation for reliability.

Direct Lender vs. Broker - Variety of Services - Reputation and Reviews

It's also important to know whether you are working with a broker or a direct lender. Direct lenders like Alliance One have in-house underwriters and can create customized programs to meet your specific needs. Brokers, on the other hand, act as intermediaries and may not have the same level of control or flexibility in structuring deals.

While most factoring companies offer similar services, the range and quality of these services can vary significantly. Look for a company that provides comprehensive support, including credit checks on your customers, collection services, and flexible funding options. Having a single point of contact who can address all your factoring needs is a significant advantage.

Research the reputation of potential factoring companies by reading reviews and testimonials from other businesses. Positive feedback from other clients can give you confidence in your choice, while negative reviews may be a red flag. Additionally, ask for references and speak directly with other businesses that have used the factoring company's services.

Transparency and Communication - Technology and Innovation - Customization and Flexibility

Choose a factoring company that values transparency and open communication. You should have a clear understanding of all terms and conditions, and the company should be upfront about any fees or charges. Regular updates and accessible customer service are also indicators of a company that is committed to supporting your business.

In today's digital age, the technology and systems used by a factoring company can significantly impact your experience. Look for a company that utilizes advanced technology to streamline processes, provide real-time updates, and offer a user-friendly platform for managing your accounts.

Every business has unique needs, and the right factoring company should be able to tailor their services to fit your specific requirements. Whether you need flexible funding options, customized reporting, or specialized support, a company that offers personalized solutions will be better equipped to help you achieve your goals.

Conclusion

Invoice factoring is a valuable financial tool that can provide immediate cash flow, improve business operations, and support growth opportunities. By partnering with Alliance One LLC, you can leverage our expertise and tailored solutions to meet your financing needs without incurring debt or compromising your business relationships. To learn more about our invoice factoring services or to take the first step, please complete our non-binding factoring application.

For more information, please visit our website or contact us directly. Let Alliance One LLC be your trusted financial partner in navigating the complexities of cash flow management and achieving your business goals.

The Process Explained, Step-by-Step

- Complete our non-binding application.

- Quick checks to ensure your company is active and in good standing, and look for any all-asset lien/UCC filings.

- Review and digitally sign our one-year agreement.

- Receive an email requesting necessary paperwork.

- Submit your file to our in-house underwriter for review.

- Within 48 hours, you will be assigned an account representative who will:

- Make an introduction.

- Start verifications of invoices.

- Send a one-time notice of assignment to debtors.

Complete verifications, then the file goes back to the underwriter for final approval.

Timeline

- Typically, it takes about one week from submitting paperwork to receiving your first funding.

- After account setup, funding usually occurs within 24 hours of sending invoices (subject to customer verification).

|

Invoice Factoring Flow Process

1. Create an Invoice 2. Send us a copy of the invoice that you are look 3. We verify the invoice for validity 4. We advance you up to 90% of the face-invoice amount, 5. We pay you and your customer will pay us directly 6. We send you back the balance in your reserve, less 7. Repeat step one |

Overview of Factoring Practices

Factoring is a financial service where companies sell their invoices to a factoring company to improve cash flow. The factoring company then collects the payment from the company's customers. This service is especially useful for businesses that experience delays in receiving payments from their clients.

Traditional Factoring

Traditional factoring companies charge a single fee, known as the factoring fee, for their services. They do not charge an Annual Percentage Rate (APR) on the funds provided. This straightforward approach ensures that businesses only pay the agreed-upon fee without any hidden costs.

Advantages of Traditional Factoring

- No hidden fees: The cost structure is transparent, with only the factoring fee being charged.

- Predictable expenses: Companies can easily anticipate the costs associated with factoring their invoices.

Alternative Factoring Practices

In contrast, more and more alternative factoring companies are adopting the practice of charging both a factoring fee and an APR on the money they provide. This means that if your customer takes 60 days to pay their invoice, you will incur the APR charges for the entire 60 days, in addition to the factoring fee.

Disadvantages of Alternative Factoring

- Higher costs: The combination of a factoring fee and an APR can significantly increase the cost of financing.

- Hidden fees: Many alternative factoring companies bury the APR fee in their agreements, making it difficult for businesses to understand the full cost until it’s too late.

Choosing the Right Factoring Option

When considering factoring options, it's essential for business owners to thoroughly evaluate their choices. The number one question to ask any potential factoring company is whether they charge both an APR and a factoring fee. If the answer is yes, it may be wise to look elsewhere.

Making an Informed Decision

Business financing is not one-size-fits-all. What works for one company might not be suitable for another. Smart business owners should explore all available options to find the best financial solution for their needs. Invoice factoring might be right for your business, but it's crucial to understand the terms and costs associated with it before making a decision.

Ultimately, the goal is to select a financial vehicle that will support the growth and success of your business. By asking the right questions and understanding the differences between traditional and alternative factoring practices, you can make an informed choice that will benefit your company in the long run. Apply Today

Alliance One LLC

Invoice Factoring for new and established & for small to mid-sized businesses

Call Us Today: 631-435-1000

HOW INVOICE FACTORING WORKS